Serving the Chapter 13 Plan

If the chapter 13 plan is filed with the petition, or before the § 341 meeting notice is docketed, the clerk’s office will arrange for mailing or electronic notice through the bankruptcy noticing center of the plan and § 341 meeting notice to all parties listed on the matrix. The § 341 notice will include the deadline for filing objections to confirmation of the plan.

If the chapter 13 plan is filed after the § 341 meeting notice is sent, the debtor must serve the plan on the trustee and all creditors per Fed. R. Bankr. P. 3015(d).

Please see Fed. R. Bankr. P. 3012(b) and 4003(d) for additional service requirements for certain chapter 13 plans. Plans that are served under Fed. R. Bankr. P. 3012(b) or 4003(d) should be accompanied by proof of service showing compliance with those rules.

Filing the Chapter 13 Plan

A. Filing the plan using case upload through petition preparation software

Attorneys using third party petition preparation software to file bankruptcy cases should make sure they have the latest upgrade from their software vendors. Petition preparation software must be updated to the vendor's latest version to allow filers to identify which "requests" (e.g., valuation, lien avoidance, surrender of collateral and assumption or rejection of leases or contracts) are included in the plan (see additional information below). If the software used to produce the upload file is not up-to-date, the screen prompting the filer to identify the “requests” will not display and the chapter 13 plan will not be docketed correctly. Upgrading to the software vendor's most recent version should resolve this issue

B. Identifying which boxes to check when filing the Chapter 13 Plan in ECF

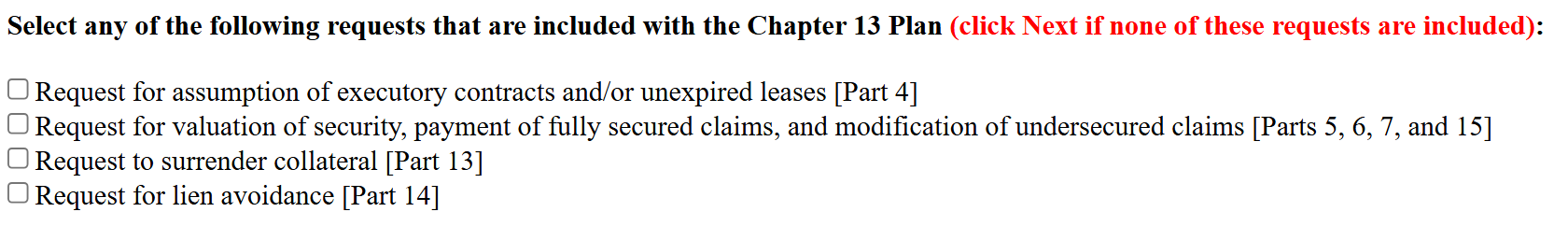

This section clarifies which boxes to check in ECF to reflect the correct "requests" included in the plan. Correctly identifying the requests in the plan allows the court to gather statistics on these requests for submission to Congress.

An example of the "requests" screen that is part of the filing of the chapter 13 plan in CM/ECF is below.

1. Valuation of security

If Part 1.1 in the Plan is checked as "included," the "Request for valuation of security" box should be checked when filing the plan in CM/ECF.

2. Security interest or lien avoidance

If Part 1.2 in the Plan is checked as "included," the "Request for lien avoidance" box should be checked when filing the plan in CM/ECF.

3. Assumption or rejection of executory contracts and/or unexpired leases

If the plan lists anything in Part 4, the "Request for assumption of executory contracts and/or unexpired leases" box should be checked when filing the plan in CM/ECF.

4. Surrender of collateral

If the plan lists anything in Part 15, the "Request to surrender collateral" box should be checked when filing the plan in CM/ECF.